Agribusiness: Coconut, Seaweed & others

Unlocking the potential of Kiribati’s Coconut sector

Agriculture: Strategic sector for growth

Agriculture contributes around 14% of Kiribati’s GDP and remains vital to rural livelihoods. Under the Kiribati 20-Year Vision (KV20), the country aims to improve land use for sustainable development, allocating 230 acres for commercial agriculture by 2026 and 320 acres by 2036*. National plans like the Kiribati Development Plan 2020–2023 and Agriculture Strategies 2020–2030 highlight coconut and seaweed as top crops for local and diaspora investment.

- The role of Coconut: Often called the “tree of life,” the coconut is deeply embedded in Kiribati’s culture, economy, and daily life. It is grown widely across the atolls it provides food, drink, shelter, and income. Copra, made from dried coconut, is the country’s most important agricultural export.

- Government action and investment readiness: To modernize the sector, the Government of Kiribati is implementing several key initiatives including replanting programs, establishment of mini copra mills and virgin coconut oil (VCO) centers, and support for cottage industries and small-scale value-added production.

- Development strategy: These efforts are guided by a Coconut Sector Development Strategy, which aims to diversify coconut-based products, promote sustainable use of resources, and increase market competitiveness.

* Baseline 170 acres

Investment opportunities

- Coconut farming & plantation expansion: Increasing production to meet rising global demand.

- Virgin coconut oil production: Cold-pressed processing for cosmetics, skincare, and health products.

- Coconut water & beverage processing.

- Copra & coconut-based products: Dried coconut, coconut flour, coconut milk, cream, sugar, and dairy alternatives.

- Coconut shell & fiber utilization: Production of charcoal, activated carbon, briquettes, and eco-friendly packaging from coconut waste.

Industry overview

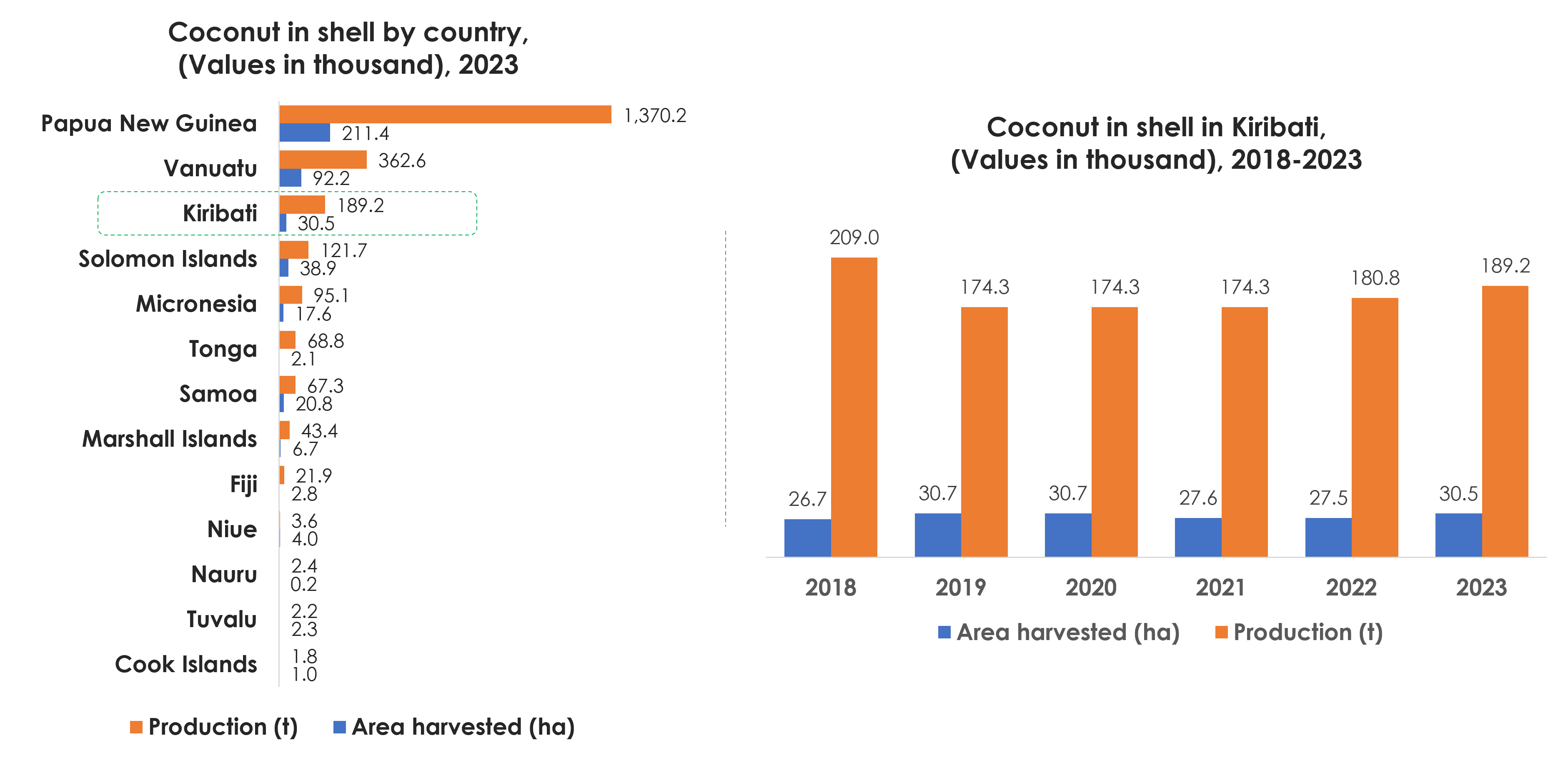

- Leading producer in the Pacific: Kiribati is currently the 3rd largest producer of coconuts in shell among Pacific Island States, trailing only Papua New Guinea and Vanuatu. In 2023, the country recorded a production of 189,200 tones, representing 8.1% of the region’s total output. In terms of harvested area, Kiribati ranks 4th, with 30,535 hectares under coconut cultivation. The country also boasts a yield rate of 6.2 tones per hectare, outperforming the regional average of 5.5 t/ha—a clear sign of its production efficiency.

- Production recovery: Over the past 5 years, Kiribati’s coconut production has experienced a gradual recovery following a notable decline in 2019. The sector has achieved an average annual growth rate of 2.1%, indicating steady momentum and the potential for further expansion.

Source: FAOSTAT

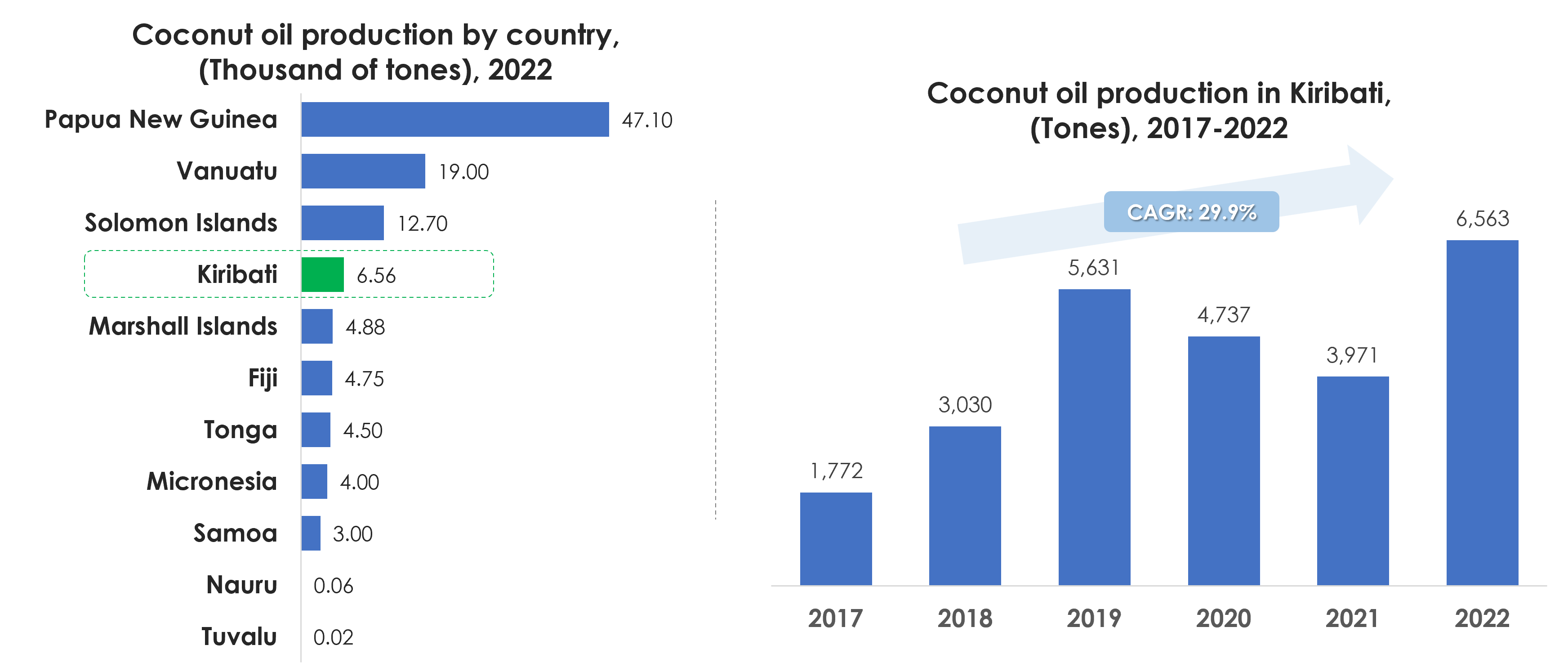

- Strong position in coconut oil production: Kiribati is also emerging as a regional leader in value-added coconut production. It ranks 4th among Pacific Island States in coconut oil production, with an output of 6,563 tones in 2023, equivalent to 6.2% of total regional production.

- Fastest-growing market in the Pacific: Over the past five years, Kiribati has seen a remarkable surge in coconut oil production, with an average annual growth rate of 29.9%, far exceeding the regional average of 10.5%. This highlights its potential for agro-processing and export-oriented investment.

Source: FAOSTAT

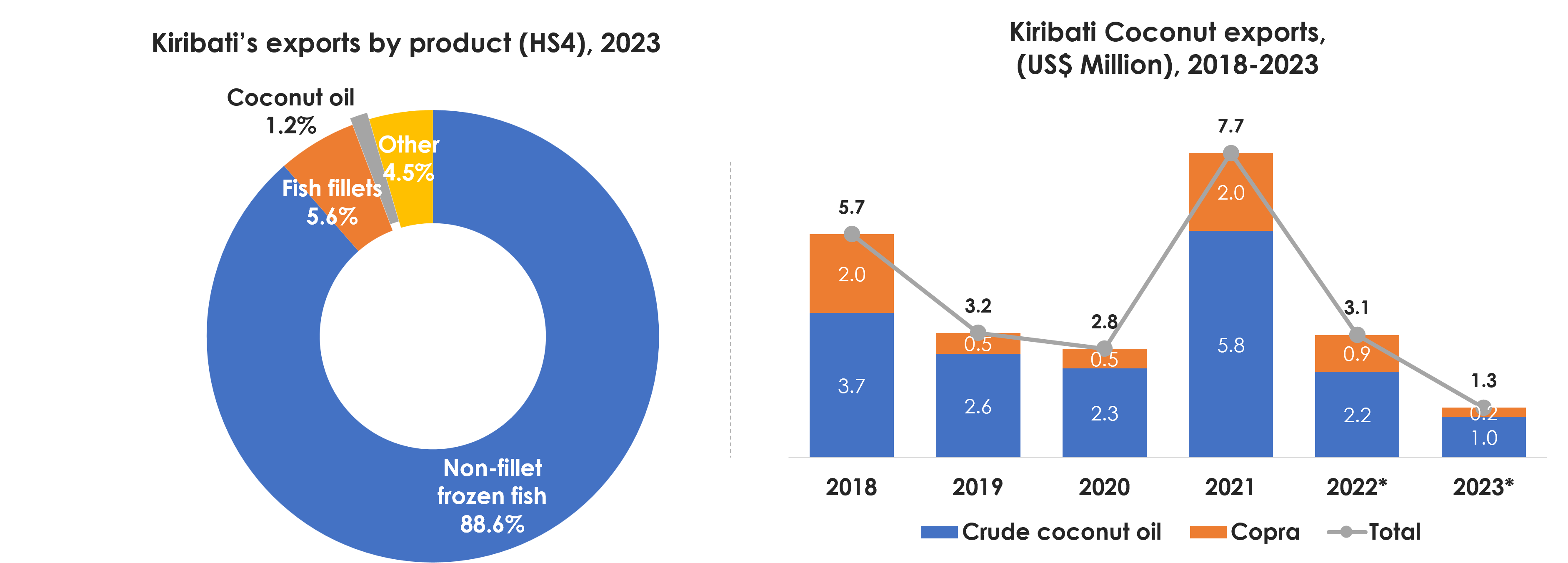

- 2nd most exported product: After fish, coconut is the 2nd most exported product in Kiribati. In 2023, coconut oil accounted for just 1.2% of total exports, valued at approximately US$1 million, followed by copra exports at US$224,000 (0.3%)—marking the lowest year on record for coconut-related exports. The highest value was recorded in 2021, when coconut exports reached US$7.7 million, representing 7.1% of total exports. The sharp decline in the past two years may be attributed to a change in data sources as export figures for 2022 and 2023 are based on partner-reported (mirror) data, rather than direct reporting from Kiribati.

Source: Observatory of Economic Complexity (www.oec.world/en)

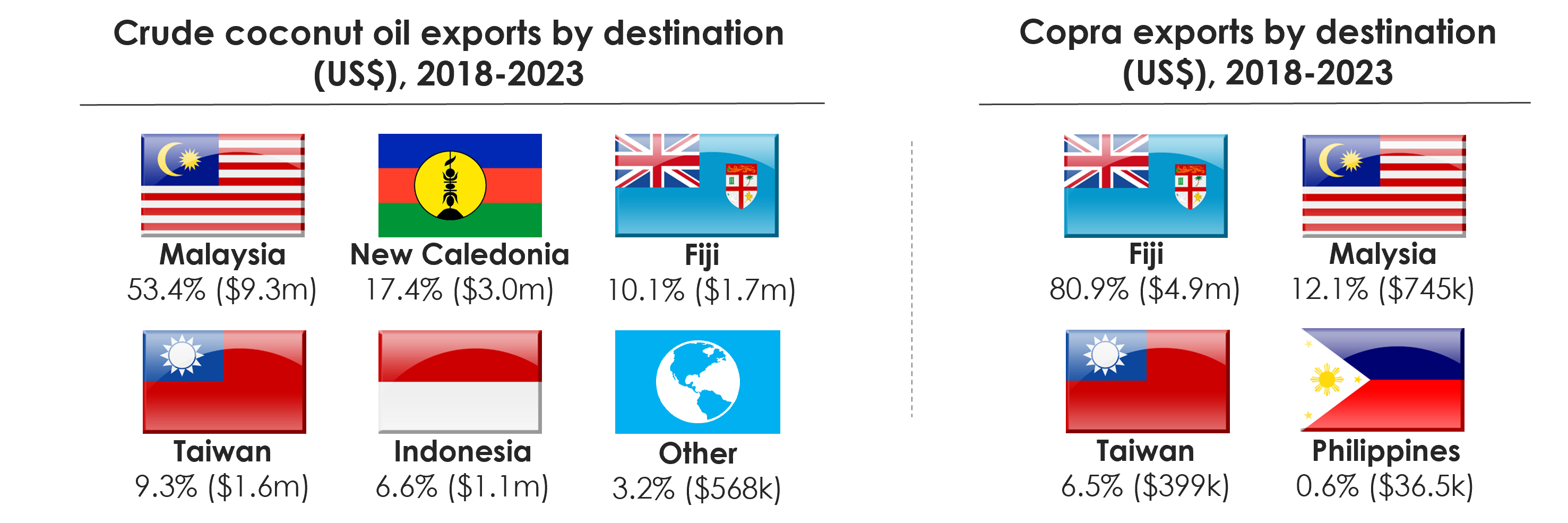

- Key export destinations: Malaysia has been Kiribati’s primary export market for Crude coconut oil over the past 5 years, receiving 53.4% of exports valued at US$9.3 million. New Caledonia (17.4%, US$3 million) and Fiji (10.1%, US$1.7 million) follow at a distance. For Copra, Fiji is the main destination, accounting for 80.9% of exports, followed by Malaysia (12.1%) and the Taiwan (6.5%).

Source: Observatory of Economic Complexity (www.oec.world/en)

Unlocking the potential of Kiribati’s Seaweed sector

The global seaweed market is rapidly expanding, driven by demand in food, pharmaceuticals, cosmetics, animal feed, and biofuels. Kiribati’s marine environment provides ideal conditions for sustainable seaweed farming.

Investment opportunities

- Seaweed farming & cultivation: Expanding production for local and export markets.

- Food & nutritional products: Dried seaweed, nori sheets, and seasoning powders.

- Hydrocolloids (agar, carrageenan, alginate): Used in food processing, pharmaceuticals, and industrial applications.

- Biodegradable packaging & bioplastics.

- Organic fertilizers & animal feed.

Other agricultural investment opportunities

Investment opportunities

- Strategic agricultural opportunities: For small and remote nations like Kiribati, the opportunity lies in producing organic, premium, and certified high-value cash crops for export. There is also strong potential to grow resilient crops for local food security and import substitution.

- Crops with export potential: Bananas, pandanus, breadfruit, and giant swamp taro.

- Import substitution crops-products: Pumpkin, wild fig, pawpaw, sweet potato, cassava, Chinese cabbage, cucumber, eggplant, tomato, spinach, and water spinach.

- Challenges for large-scale agriculture: While opportunities exist, large-scale agriculture in Kiribati faces major constraints. These include limited land, scarce surface water, and a widely dispersed geography. Other challenges are poor inter-island connectivity, frequent droughts, disaster risks, and generally infertile soils—all limiting scalability and resilience.