Fisheries

Fisheries: A pillar of growth and sustainability

- Key driver of the economy: Fisheries are at the heart of Kiribati’s economy and community livelihoods, contributing around 10% of GDP and generating over 90% of the country’s exports. With one of the world’s largest Exclusive Economic Zones (EEZs), Kiribati is a key player in the tuna-rich waters of the Parties to the Nauru Agreement (PNA) region.

- National priority for the future: Recognized as a priority sector in both the Kiribati 20-Year Vision (2016–2036) and the National Investment Policy Framework (2018–2028), the fisheries sector is poised for significant growth. National targets aim to boost the net value of offshore fisheries by 75% by 2027 and 100% by 2036¹, while also increasing coastal and subsistence fisheries by 10 by 2027 and 20% by 2036².

- Guided by clear policies and strategic plans: This ambition is supported by clear strategies and policies including the National Fisheries Policy (2013–2025) and the National Coastal Fisheries Roadmap (2019–2036), that pave the way for sustainable development, value addition, and private sector participation.

- Strategic location and infrastructure potential: Kiribati’s central Pacific location, outside the cyclone belt, makes it an ideal hub for transshipment, cold storage, and fisheries-related infrastructure, offering unique opportunities for investors in processing, logistics, and value-chain services.

¹ Baseline 25% - ² Baseline 1%

Potential investment opportunities

- Sustainable commercial fishing: Fleet expansion and modernization.

- Coastal fisheries: Aquaculture farms, hatcheries, and nursery facilities.

- Processing & value addition: Fish processing plants (filleting, freezing, canning), fishmeal and fish oil production.

- Cold chain logistics: Warehouses, refrigerated transport, air cargo expansion, upgraded fish landing sites.

- Seafood certification: MSC & ASC certification services and traceability systems.

- Maritime repair & resupply: Shipyards, dry docks, marine fuel, and resupply stations.

- Maritime infrastructure: Transshipment hubs, jetties, wharves, and inter-island transport terminals.

Industry overview

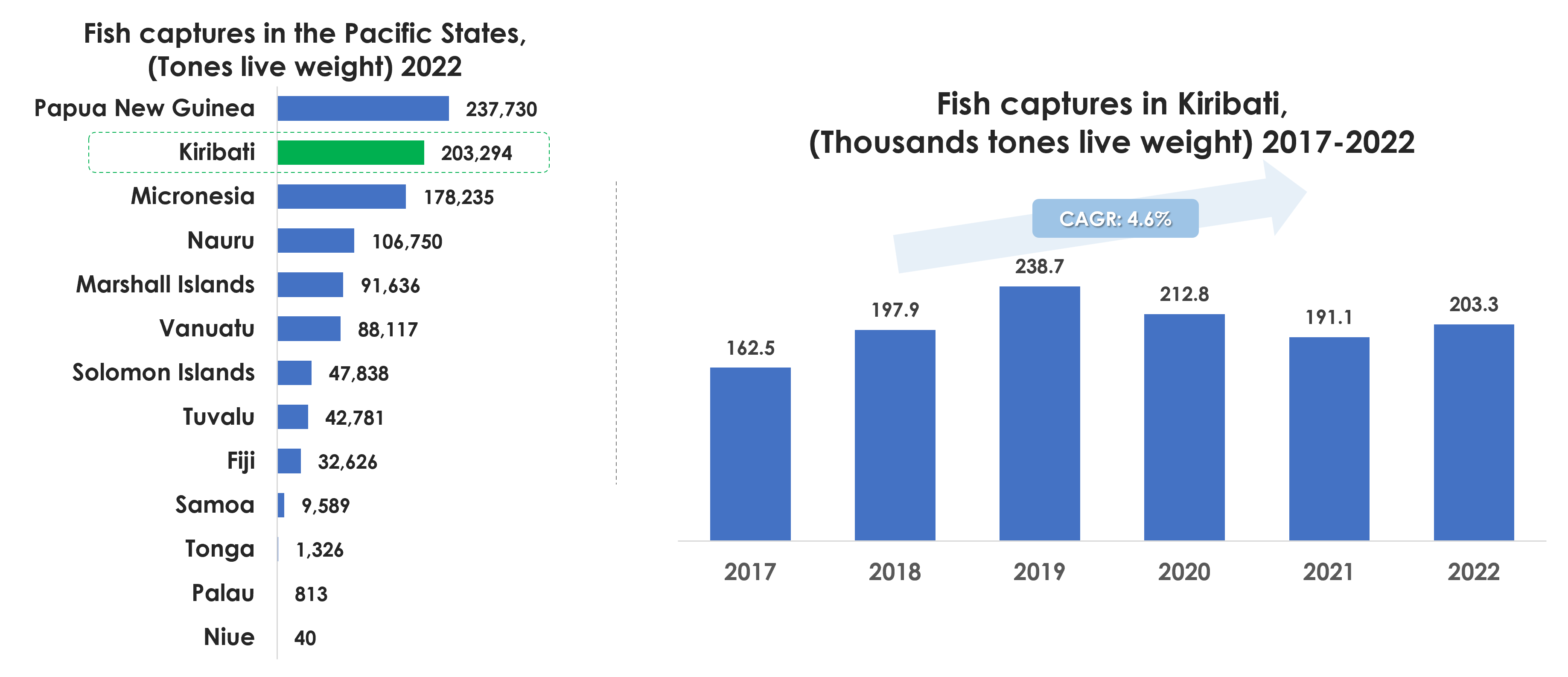

- Leading producer in the Pacific: Kiribati is currently the second-largest capture fish producer among Pacific Island States*, trailing only Papua New Guinea. In 2023, the country recorded 203,294 tones of captured fish, accounting for 19.5% of total regional production.

- Most commercial fishing species: Tuna relates species (kipjack, yellowfin, bigeye and albacore), swordfish, marlin, grouper, snapper, trevally, parrotfish, rabbitfish, lobster and shellfish.

- Consistent growth in output: Over the past five years, Kiribati’s capture fisheries have shown a positive and resilient cyclical trend, with an average annual growth rate of 4.6%. This growth mirrors the broader Pacific region’s trajectory, which saw a 5.0% during the same period, highlighting Kiribati’s strong positioning in a thriving sector.

- Competitive licensing & tax incentives: Kiribati offers one of the lowest fishing license fees in the Pacific at US$131/ton, well below the regional average of US$366, plus a 5-year tax exemption for investors.

* Excluding overseas territories of other countries - Source: FaoStat.com

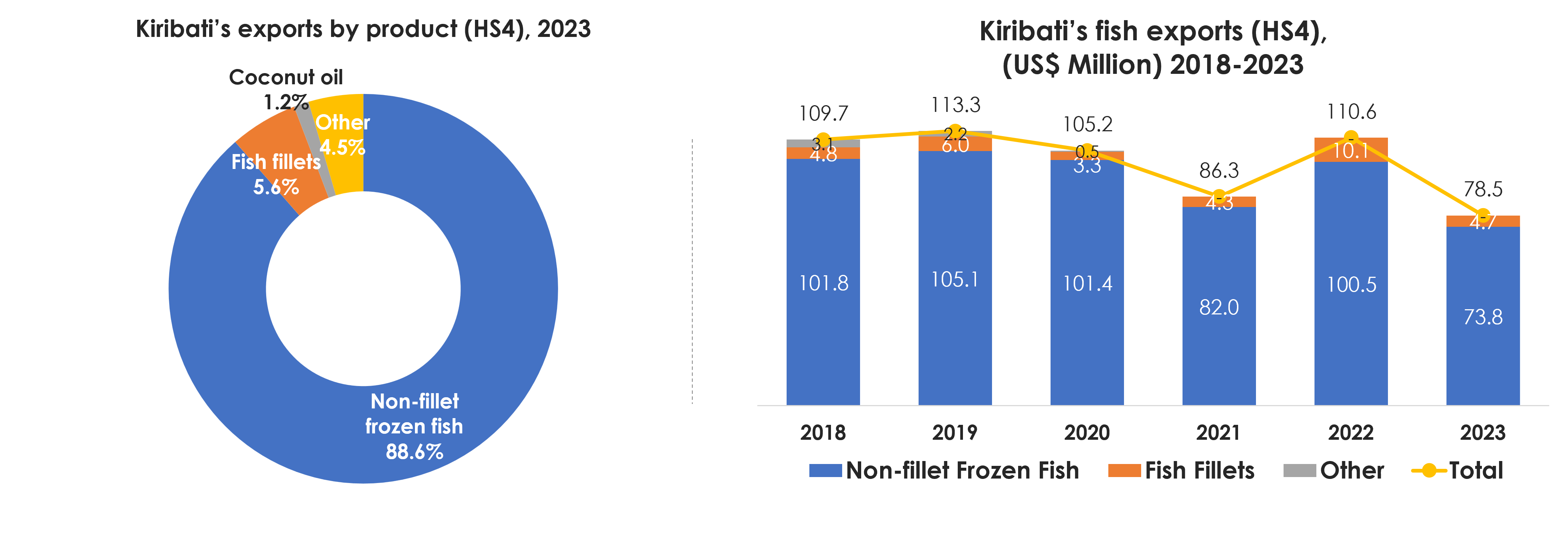

- Main source of foreign exchange: Fisheries is Kiribati’s primary industrial sector and the largest generator of international foreign exchange, accounting for over 94% of total exports, valued at US$78.4 million in 2023. From this Non-fillet frozen fish is the main byproduct sharing 88.6% equivalent to US$73.7 million, followed by Fish fillet with 5.6% equivalent to US$4.6 million.

- Export performance and trends: Fish exports have shown a cyclical pattern, with a declining trend over the past five years and an average annual growth rate of -6.5%. The value peaks were was recorded in 2019.

- Non fillet frozen fish dominates export mix: In 2023, it made up 94% of total fish exports, valued at US$73.8 million. Fish fillets represented the remaining 6%, equivalent to US$4.7 million, demonstrating a potential niche for value-added processing and diversification.

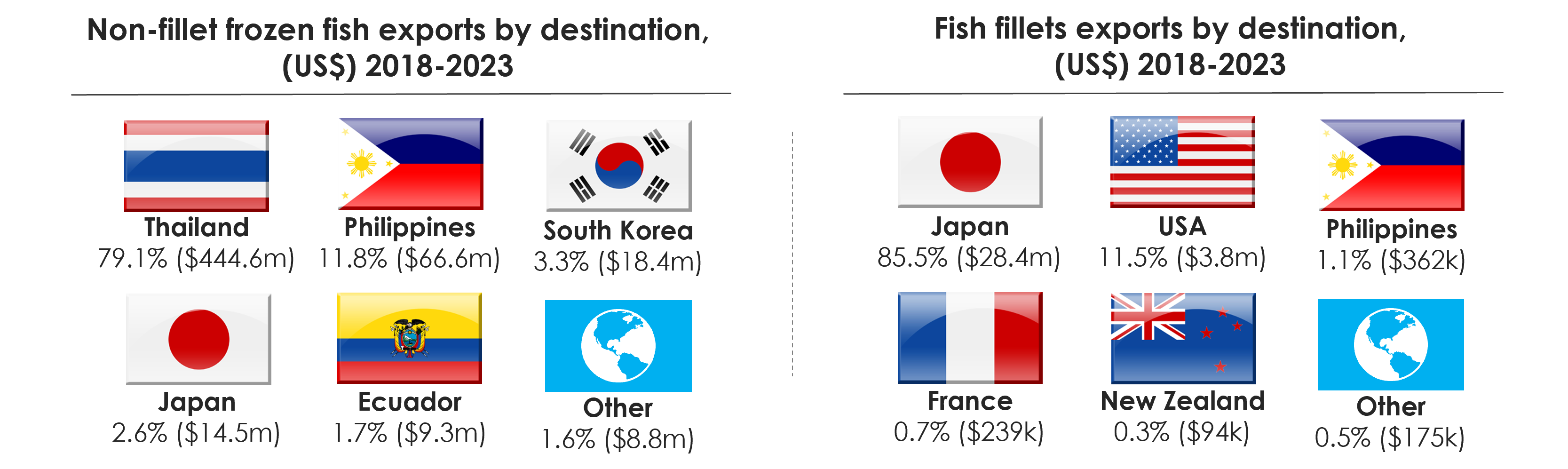

- Key export destinations: Thailand has been Kiribati’s primary export market for Non-fillet frozen fish over the past five years, receiving 79% of exports valued at approximately US$444 million. The Philippines (11.8%, US$66 million) and South Korea (3.3%, US$18 million) follow at a distance. For Fish fillets, Japan is the main destination, accounting for 85.5% of exports, followed by the United States (11.5%) and the Philippines (1.1%).

Source: The Observatory of Economic Complexity (www.oec.world/en)

Market players

Kiribati Fish Limited (KFL) is a joint venture company established in 2010. The ownership is shared between the Government of Kiribati (40%), Golden Ocean Fish Ltd of Fiji (40%), and Shanghai Deep Sea Fishing Company of China (20%). Based in Betio, South Tarawa, KFL operates a modern fish processing facility completed in 2012, valued at approximately US$8 million. The company focuses on processing and exporting high-quality fresh and frozen tuna to international markets, including the European Union, United States, and Japan.

Central Pacific Producers Limited (CPPL) is a government-owned company established in 2001 and based in Tarawa, Kiribati. Owned by the Ministry of Fisheries and Marine Resources Development, CPPL has operations in offshore and inshore fishing, seafood sales, shipping services, and crewing for foreign fishing vessels. The company acts as an agent for fishing firms from South Korea, Taiwan, and China, and helps recruit local seafarers for employment on these vessels. CPPL also sells reef fish, deep-bottom fish, seaweed, ice blocks, and fishing gear.